With a conventional lender, the appliance approach can take weeks. Then, For anyone who is permitted, you’ll almost certainly hold out Yet another various weeks for your loan money to come by.

What helps make SBA loans so valuable? Initially, the SBA federally backs the loans so they’re a lot less dangerous to lenders, rendering it less complicated so that you can get a loan with lessen desire fees. In addition, they've differing kinds of SBA loans that each one supply small interest rates, very low down payments, and extensive-expression funding.

SBA loans are intended to ensure it is less complicated for small businesses to have funding. In case your business has fatigued all other financing selections, you might be able to get an SBA loan.

A merchant hard cash progress is frequently among the list of swiftest types of funding your business could get, and good credit usually isn’t required. In this article, your earlier product sales (commonly via credit score and debit playing cards, or on line income) will likely be analyzed and, When your business qualifies, you’ll get an progress against foreseeable future sales.

Daily life insurance doesn’t have to be complicated. Uncover reassurance and choose the proper policy to suit your needs.

Credit score score demands for your small business loan will vary by lender, but frequently, lenders search for a credit score within the mid to substantial-600s. Nonetheless, some lenders take into consideration decrease credit history scores at the same time.

When you’re not experience similar to the SBA 504 loan is best for your needs, there are lots of other SBA loan programs to think about as you decide what’s most effective for your personal business.

Loan guarantees are what give personal lenders the confidence to supply SBAs with lessen payments and more versatile terms.

“We assume 2019 to be An additional occupied yr of more info business growth and look ahead to supporting equally new and present clients extend their footprints.”

We hope you observed our posting helpful and may locate the resources, or funding, you may need on your small business to increase and prosper.

The standard SBA seven(A) is the most common, and most versatile SBA loan. With a loan level of around $5 million plus the widest choice of employs, it may possibly gain any business that’s qualified.

However , you’re minimal in what You should use this loan for, and you have to fulfill the SBA’s and lender’s necessities to qualify. Along with that, SBA loans are known for their gradual acceptance approach, even though other lenders supply quick funding in as small as a couple of days.

The procedure was SO incredibly straightforward. Everything was done in a day. … I'll without a doubt use Lendio Sooner or later as my business grows.

Nationwide Funding is another lender, which implies we work along with you, the small business operator. Our course of action lessens the length of time it's going to take to overview your small business loan software.

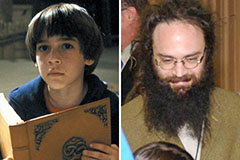

Barret Oliver Then & Now!

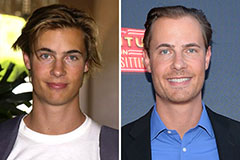

Barret Oliver Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now!